For many people, the end of financial year triggers feelings of anxiety and doubt, but there is no need for that! If you are organised and well equipped in advanced, you can prepare for a seamless and stress free EOFY. Below, you will find 5 top tips to avoid missing out at the EOFY.

-

Prepare early

There’s no need to wait until the end of June to get ready for the EOFY. Preparing early is the key to ensuring that your EOFY runs smoothly. Gathering all relevant invoices and receipts and accounting for all income is a great place to start.

-

Keep records of all business-related purchases

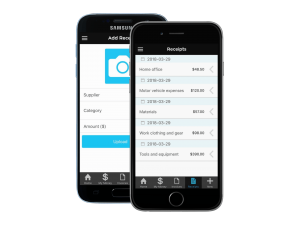

Storing receipts in shoes boxes is a peril of the past. Maintaining records of all business-related expenditure is a must. This task is made simpler by utilising the systems available to you such as our Solo & Smart app where you can record and store invoices and receipts. To avoid the mad EOFY rush, it is best to keep track of these records throughout the year. Each time you make a business-related purchase, add it to your records right away. Most accounting software have a functionality allowing you to take a quick photo of an invoice or receipt, which it will store in the system immediately.

-

Consider all possible deductions

The types of expenses, which you may be able to claim is dependent on how you are employed. To find out more about what you can and cannot claim as a sole trader, see our blog, “How to increase your tax return; what you can and can’t claim as a sole trader”. As an employee, you can make specific types of deductions such as vehicle and travel expenses, self-education expenses, donations, home office expenses and interest and dividends on investment income. Specific industries and occupations will allow for specific deductions related to that line of work. These deductions may include phone allowances, meal expenses and clothing expenses.

-

Keep your business and personal expenses separate

If you are self-employed or work from home in your employed role, it is important to keep your business and personal expenses separate. In some instances, you may have to split certain expenses in order to account for time that it is used for a business-related purpose. There are particular expenses that can be claimed as part of your at home work space. For example, you can claim the cost of using utilities such as gas and electricity, work-related phone costs and the depreciation of office equipment such as computers, desks and chairs.

-

Prepay expenses

Did you know that you can claim deductions for expenses which you have prepaid? If you prepay expenses such as business insurance and professional subscriptions before 30 June 2018, you can claim these as a deduction for your tax return. In fact, bringing forward tax-deductible expenses and deferring income can work to reduce your taxable income for the financial year.

When it comes to tax time, your accountant is your secret weapon. Whether it be completing your tax return or setting you up on the right system like Solo & Smart, you can be sure that a professional accountant can take care of you at EOFY.