The end of financial year means one thing for sole traders… it’s time to sort out your claims! As a rider, you can claim a deduction if the expense is directly related to the running of your business. Below, you will find a list of what you can and can’t claim as a sole trader

What you can claim

Business asset purchases of up to $30,000: If you purchase a motorcycle or bicycle for example, that costs $30,000 or less, rather than claiming depreciation over time, you could be eligible for an instant tax deduction. To be eligible, the asset must be first used by, or ready for use, within the following thresholds:

$30,000: from 2 April 2019 to 30 June 2020

$25,000: from 29 January 2019 to 2 April 2019

$20,000: before 29 January 2019

Prepaid expenses: You can claim a deduction on some prepaid expenses relating to your business. For example, if you pay a yearly business insurance premium on a motor cycle before 30th June 2019, you may claim this in your tax return.

Business establishment costs: If you have started a new business in the 2018-2019 financial year, you can claim deductions for the costs of starting up your business. This includes relevant government fees such as company registration and the cost of seeking professional advice from your lawyer or accountant.

Account and loan expenses: You can claim back the fees on your business banking accounts and business loans.

Motor vehicle use: As a sole trader, you can claim a tax deduction for use of a vehicle that your business owns, leases or hires under a hire purchase agreement. A claim can only be made if the vehicle is being used for business purposes. Motor vehicle expenses can include fuel, repairs and maintenance, insurance, registration and interest on loans. There are several other types of deductions which you may be able claim, such as road safety gear and travel expenses such as bus fares and taxi fares.

What you can’t claim

There are certain expenses you can’t claim in your tax return. Furthermore, there are some expenses where you may be able to make a partial claim based on the proportion of time that you use the expense for business purposes.

Entertainment expenses: If you are a sole trader, you cannot make a claim for entertainment expenses.

Fines: Fines are not tax deductible. For example, if you incurred the traffic fine during working hours or in the course of business, you cannot make a claim.

Private expenses: Private expenses may include rent and Uni fees. While you can make a claim on education relating to your current business, you cannot make a claim for self-education relating to a different area of your personal life or an unrelated business.

Goods and Services Tax (GST):Do you know if you are registered for GST or not? You can check online by going to the ABN Lookup, here: https://abr.business.gov.au . If you’re not registered you will not be charging your customers GST and therefore not claiming GST credits. However if you are registered for GST, you will be charging your customers GST and you can claim the GST credit on purchases. Just be sure to check you haven’t already claimed the credit on your business activity statement (BAS).

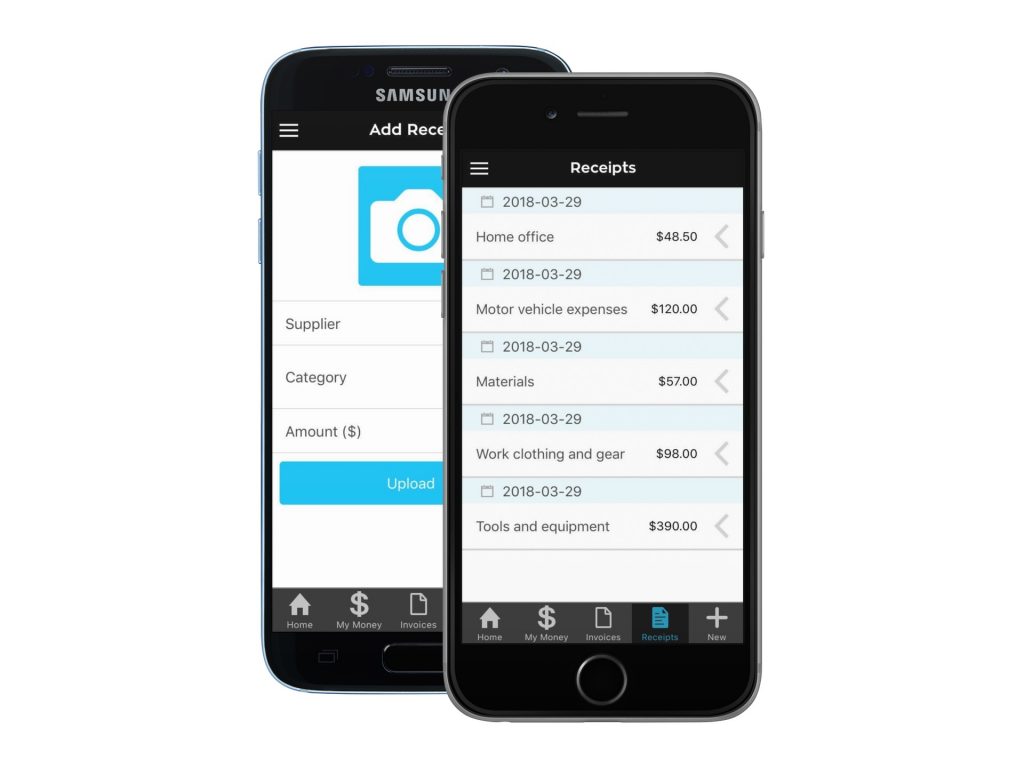

In order to make the most of your tax return, you need to be making a claim on each eligible expense for the financial year. This is easy to do with the ability to capture and track all of your receipts in the Solo & Smart app! Having an experienced accountant on your side and a system to keep on top of your receipts, will help you achieve just that. The above blog is by no means an exhaustive list of what can and cannot be claimed. To find out more, you should contact your tax accountant.

This information is for general information purposes only and does not claim to be comprehensive. This is not tax advice or financial advice and any reliance on this information is solely at your own risk. We exclude any liability or responsibility for any loss which may arise from reliance upon information appearing in this blog, or arising from access to, or use of, information provided on this blog.