Beating the cash-flow challenge

The tax man is killing me

Sadly in Australia, each year micro businesses find themselves in tens of billions of dollars in debt to the tax office. It is a major factor why over 50% of businesses fail within 3 years.

I never have any profit

You should be rewarded for all your hard work and having a profit in the bank at the end of the financial year should be a priority.

My income is too inconsistent

Having lumpy and inconsistent cash-flow can be easily managed by building a safety net into your day to day money management.

The Solo & Smart Approach

Our automated approach is about allocating money to where it needs to be as soon as it’s received. It’s a simple fact of life that the more we earn, the more we tend to spend. Setting aside income to meet these financial commitments first, allows you to focus on what you do best.

Tax Savings

Paying tax is a part of life, but being prepared removes all the stress. It can mean the difference between getting money back or having a huge bill you can’t afford.

Super Savings

Being self-employed means that it’s up to you how you contribute to super. Having a structured approach to saving guarantees the money will be there for retirement.

Rainy Day Savings

Saving for a rainy day is all about building a safety net or plan b into your daily and weekly rountine. The benefits shine through when the lumpy cash-flow hits.

Profit Savings

Profit is the aim of the game, it’s the reward you get for all your hard work, but it can’t be left to chance. Being proactive about profit is essential to making it happen.

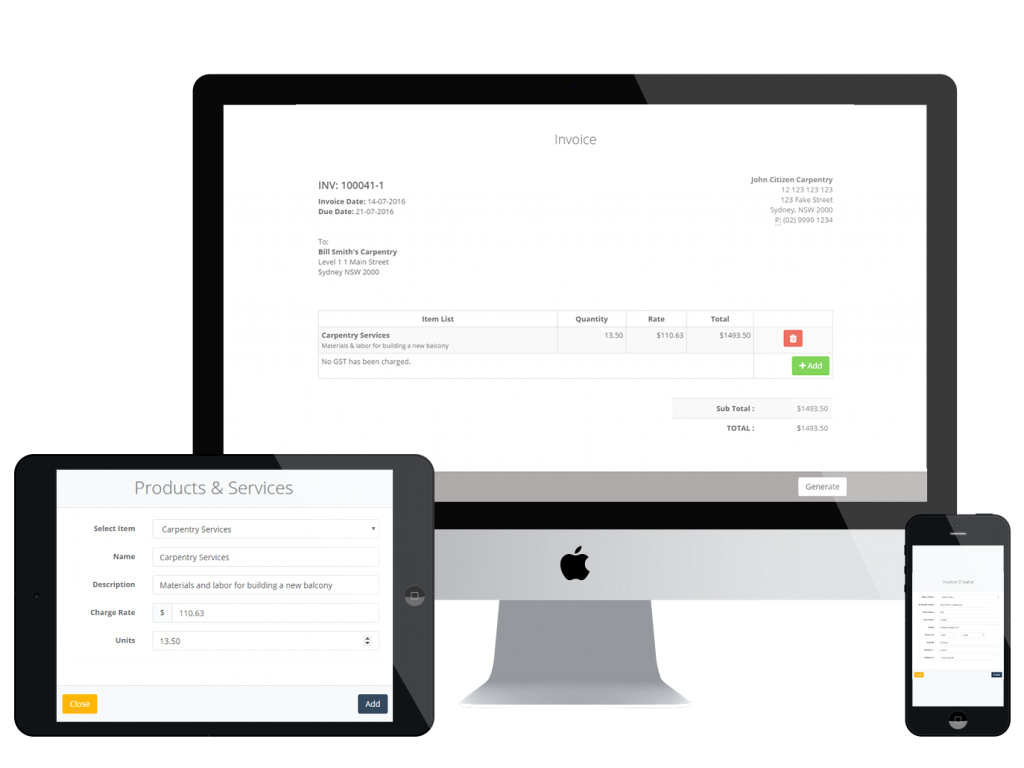

Automating cash-flow to save you time and money

Step 1: Payments land in your account

Your clients or customers pay you into your Solo & Smart business bank account. This account is created especially for you and is designed to be seperate from your normal operating account. By keeping this account separate, we can automate the movement of money out of the account based on your settings. It also means any savings in your account are kept out of sight and out of mind.

Step 2: You choose your settings for tax, super, profit or a rainy day

Every business is different and has it’s own unique needs. The Solo & Smart app allows you to easily select a percentage to put aside as savings for tax, super, profit or a rainy day. You simply choose the percentages that work best for you and those settings are automatically applied to every payment that lands in your account. Your savings will build up in your Solo & Smart business account, but don’t worry it’s your account and your money, you can access it through the app at any time.

Step 3: Your free to spend money

Once your savings have been put aside, all of your free to spend income is sent through to your operating or everyday account. The beautiful thing is that you know your financial commitments have been taken care of and the money in your bank is yours to spend. Your free to spend money can be sent to any bank and we transfer the payments to you on a daily basis so you never have to wait long for the money to be in your account.

Watch your savings grow on autopilot

Imagine the freedom of knowing you can focus entirely on what you do best, assured that all your financial commitments are organised and on-track.

Reporting made easy

Sales Reports

Keep on top of who your best customers are and who you need to work on.

My Money Reports

At a glance be able to see your income and expenses as a detailed summary.

Income Reports

Access up to date information on all your income for a given period.

Savings Reports

Instantly access the balance of your savings accounts, so you know where you stand.

Expense Reports

Have the details of your expenses at your fingertips.

Debtor Reports

Keep on top of overdue payments and manage your difficult payers.

Only pay for insurance you actually use

Solo & Smart’s unique insurance package allows you to access Public Liability and Personal Accident & Sickness insurance, which is based on a percentage of the work you get paid for.

You get paid first

If your not working, why should you have to pay for insurance that you’re not using?

Only pay a small % on the contract value

Public Liability is charged at just 0.66% of your earning and Personal Accident & Sickness just 3% of earnings.

Peace of mind you and your business are covered

You can rest easy, knowing that you have cover in place and you only pay for what you use.